Michigan Debt Relief

Take control over your debt and become financially free with the help of Optimal Debt Solutions. Our team of Michigan debt relief experts can assist you in your endeavor and create a working financial plan that works for your needs.

Being unable to pay your debts, especially on time, can be very stressful. Some creditors may harass you and your family wherever you go until you pay. Others may even sue you without sitting down with you to make a workable settlement.

In our company, we believe that everyone deserves to be financially free and be treated with respect by financial groups. We will help you understand your financial capacity, find solutions to reduce your debt, and guide you to financial freedom. You can try our evaluation for free, and our certified debt specialists will be on your case to show you how you can be financially free with our recommendations.

Call Optimal Debt Solutions today at (313) 488-3144 for your Free Evaluation!

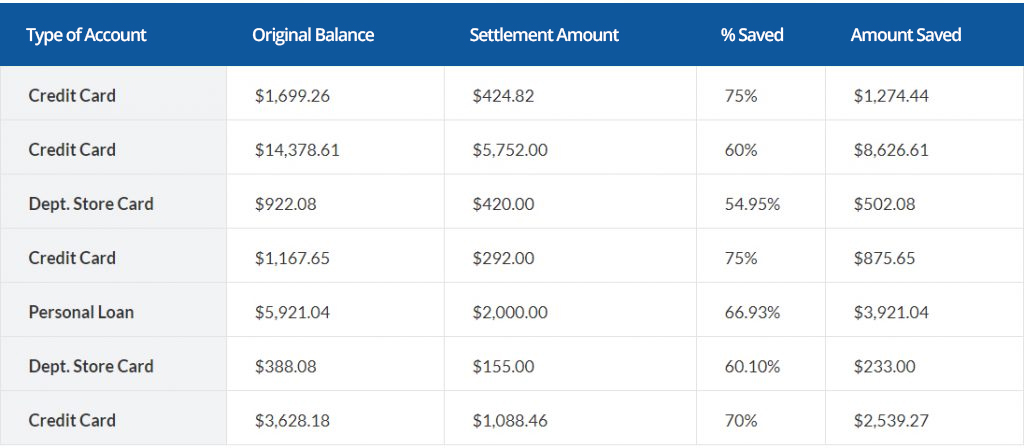

Dramatically Reduce Your Debt

With our debt settlement program, you can get a new payment term that you can work with easily and sort your debts quickly. We can negotiate new terms for the following debts:

- Credit Card Debt

- Medical bills

- Unsecured Loans

- Collection Accounts

- Repossessions

- Payday loans

We can also help you if you are in debt collection. Our Michigan debt relief specialists will evaluate your account for free and find an ideal solution for it.

Debt Settlement Vs. Debt Consolidation

When you request for debt relief, you may notice that there are a variety of solutions available for you to use. They all vary on how they work and how quickly they will get you out of debt. The quickest way to do it is by debt settlement.

When you consolidate your debts into one through debt consolidation, you are effectively opening a new loan that has a lower interest rate. The amount you will take out will then be used to pay all your existing credit. While it does reduce the number of payments you have to pay each month and the payment due dates you need to keep track of, you still have a debt to pay. Sometimes, it may take you five years or more to pay off this debt if you do not accumulate more debt.

However, debt settlement is faster because you can negotiate a new plan where you can pay off your creditors faster by up to 50%. The amount you have to pay and how often will be reduced every month. This will save both time and money for you and help you start reviving your financial rating.

Effective Debt Relief Negotiation

Optimal Debt Solutions is committed to helping all Michigan clients control their debts with the perfect program with their situation in mind. We will go directly to the creditors to reach a compromise on how to get your debts paid with a lower amount that your finances can handle.

Since we began, we have assisted thousands of clients who have nothing but praise with our personalized service. We know that every client is unique, and we will do our best to create a program that will help you control your debts.

Our fees will be included in the deposits you will make for the program, including the costs we had to pay for the negotiation. As the program proceeds, you will see a big improvement in your situation and improve your life in the process.

Michigan Debt Relief Company

Call Optimal Debt Solutions today at (313) 488-3144 for your Free Evaluation!